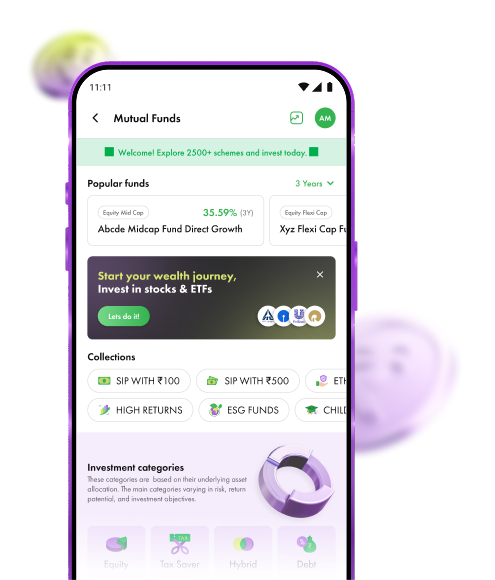

Invest smarter, invest better with Arihant Plus

5000+ Mutual Funds, Find the Right One on ArihantPlus

Explore by Category

01

Better Than Fixed Deposits

02

Index Funds

03

All-Size Companies

04

High-Risk, High-Returns

05

Large-Cap Funds

06

High-Quality Debt Funds

07

Save Tax, Invest Smart

08

Gold Investments

Curated for You

01

High Return

02

My First Crore

03

Long-term Portfolio

04

SIP with ₹500

05

ESG & Ethical Funds

Download the app and discover more.

Invest in tomorrow with just one click

By signing up, I agree to the T&C, Privacy Policy and Tariff rates and give my consent to open Demat and Trading account in Arihant Capital.

3 Simple Steps

Investing in mutual funds is quick, easy, and hassle-free. Follow these three steps to begin your journey today.

01

Open Your Free Account

Complete your digital KYC in minutes and get started instantly.

02

Choose Your Mutual Fund

Explore top-performing funds and pick the right one for you.

03

Invest Your Way

Start an SIP from or invest a lump sum amount as low as ₹100.

Turn Dreams into Reality with Goal-Based Investing

Secure your future with ArihantPlus— link your mutual funds to your life goals, monitor progress, and stay on track with ease.

Two Smart Ways to Invest

Whether you prefer consistency with SIP or a one-time Lumpsum investment, we make it simple and seamless.

Investing in SIP

- Invest small amounts regularly for long-term growth.

- Benefit from rupee cost averaging and market fluctuations.

- Automate investments for hassle-free wealth building.

Investing in Lumpsum

- Invest a large amount in one go

- Ideal for those with surplus funds and long-term vision.

- Take advantage of market opportunities instantly.

Investing in Mutual Funds Made Simple, Just for You

Arihant Digest

Join 2.5+ Lakh Investors Who Trust Us

Investing on ArihantPlus is quick and seamless:

- Open a free mutual fund account by completing digital KYC.

- Browse and select from 5000+ mutual fund schemes.

- Start investing with a one-time lump sum or a SIP starting as low as ₹100.

Mutual funds are regulated by SEBI (Securities and Exchange Board of India) and managed by professional fund managers, making them a secure investment option. However, like all investments, they carry some level of risk based on market fluctuations. Choosing the right fund based on your risk appetite and investment goals can help you manage risks effectively.

SIP (Systematic Investment Plan) is a method of investing in mutual funds where you contribute a fixed amount at regular intervals (monthly, quarterly, etc.). It helps in disciplined investing, rupee cost averaging, and compounding over time, making it a great choice for long-term wealth creation.